USDA adds to the bearish wheat tone…

- By: "Farm Tender" News

- Cropping & Grain News

- Jul 16, 2024

- 280 views

- Share

By Peter McMeekin

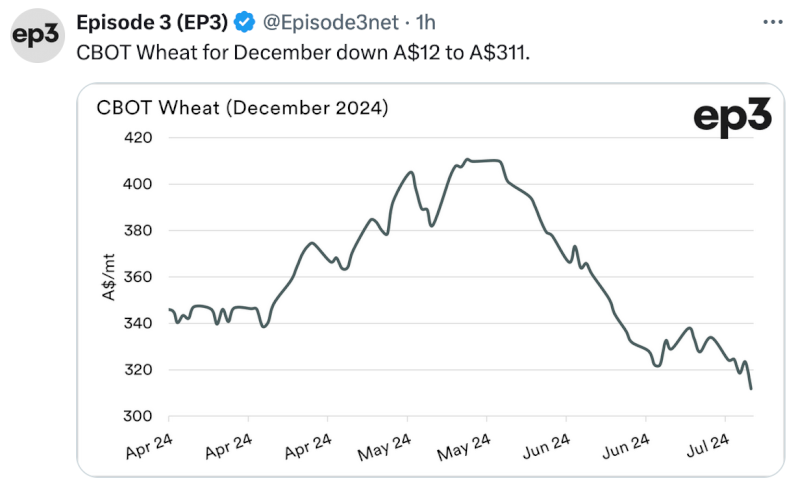

The United States Department of Agriculture released its global supply and demand update last Friday, dealing another round of bearish news to the international wheat market. Assuming the production forecasts come to fruition, the international market will need to unearth some serious additional demand over the next twelve months if the 2024/25 balance sheet is to tighten enough to provide meaningful price support.

According to the USDA’s World Agricultural Supply and Demand Estimates, the global wheat outlook is for higher production, consumption, international trade and ending stocks in 2024/25. Worldwide wheat production was pegged at 796.2 million metric tonne, 5.4mmt higher than the June update. Add the 1.4mmt increase in carry in stocks following some 2023/24 balance sheet adjustments, and total supply increases 6.8mmt compared to last month.

Among the major exporters, wheat output in the US came in at 54.7mmt in last week’s report, up from 51mmt in June and 49.3mmt in 2023/24. The export revision was relatively subdued, increasing only 2.7mmt to 23.3mmt on the expectation that the US exporter will find it challenging to engage the consumer with ample global supplies.

Argentina’s production forecast was increased by 0.5mmt to 18mmt compared to the June report, 2.3mmt higher than the previous season. This aligns with the most recent update from the Buenos Aires Grain Exchange but is 2.5mmt lower than the Rosario Board of Trade, which has held a very bullish outlook on new crop production for some months. Argentina’s 2024/25 export projection remains at 11.5mmt, up from 8.5mt in the South American nation's current marketing year.

The Australian wheat crop remained unchanged month-on-month, with the forecast of 29mmt now 3mmt higher than the 2023/24 harvest. However, that estimate does not remotely reflect the significant turnaround in the new crop production outlook over the past six weeks, with forecasts at or above 34mmt becoming increasingly common.

Australia’s old crop export estimate of 20mmt is becoming increasingly possible as the season progresses, and the 2024/25 projection of 22mmt is in line with local trade ideas. However, why the USDA keeps 0.2mmt of exports in the matrix every year is a mystery, as is the horrendously low domestic demand forecast of just 7mmt. With record cattle on feed across the country and the poultry sector increasing rapidly, the USDA’s domestic feed figure of 3.5mmt is around 50 per cent of reality.

Wheat production in Canada received a 1mmt kicker on Friday, increasing to 35mmt compared to the June forecast due to the dramatic improvement in seasonal conditions across the Prairies since winter. This is up 3mmt compared to the previous harvest, despite a one per cent decrease in the planted area year-on-year. The export projection of 25mmt is 0.5mt higher than the June number but unchanged compared to 2023/24.

The European Union’s wheat output forecast of 130mmt is down 0.5mmt compared to June and 4.2mmt lower than the 2023 harvest. Nonetheless, the July estimate remains a tad lofty compared to the most recent forecasts from the European Commission and Strategie Grains, both of which sit at around 128mmt. The EU wheat export forecast took a similar hit, down 0.5mmt to 34.5mmt, 2.5mmt lower than 2023/24 shipments of 37mmt.

The Russian wheat production outlook appears to have stabilised in recent weeks, with the USDA taking a similar approach, leaving its forecast unchanged month-on-month at 83mmt. This is down from 91.5mmt last year but is in line with the average of local estimates. Respected Black Sea analyst SovEcon recently raised its wheat crop projection from 80.7mmt to 84.1mmt on the back of better-than-expected early harvest yields. The Russian Grain Union called the crop 85mmt, up from its June estimate of 82mmt. Prozerno also called the crop 82mmt, 1.1mmt higher than its June forecast, and IKAR added 0.5mmt to its June estimate to land on 82mmt as well.

On the Russian export front, the USDA raised old crop exports from 54mmt in the June report to 55.5mmt last week, well above most local Russian forecasts. New crop shipments were pencilled in at 48mmt, unchanged from its June update, on the back of the lower production expectations and lacklustre global demand. Earlier in the month, SovEcon updated its new crop export prediction to 46.1mmt, down from its 2023/24 estimate of 52.2mmt.

As the war rages on in Ukraine, the country’s farmers remain resilient. This year’s wheat harvest is expected to be 19.5mmt, unchanged from June but down from 23.0mmt last year, on the back of a smaller planted area. The export projection of 13mmt is unchanged from last month but is down significantly from 18.1mmt in 2023/24.

Pakistan’s farmers are on track for record wheat production in 2024/25, with the USDA adding 1.4mmt to its June estimate to peg the crop at 31.4mmt. This is up from last year’s harvest of 28.2mmt, continuing to move the country closer to self-sufficiency. According to the USDA, domestic consumption will be 31.2mmt, and when adding a carry-in of 5mmt, there is a serious possibility of Pakistan turning from a net importer to a net exporter of wheat in 2024/25.

Elsewhere, India’s 2024/25 wheat production estimate was left at 114mmt, despite many private forecasts sitting in the 100-104mmt range. Rumours were circulating again late last week that India will drop the 44 per cent wheat import duty imposed six years ago, suggesting that domestic production may fall short of expectations. China also fell into the unchanged category month-on-month at 140mmt, up from 136.6mmt in 2023/24. The USDA is calling Chinese domestic consumption 151mmt in 2024/25, down from 154mmt last season.

On the global demand side of the equation, the USDA increased China’s 2024/25 wheat imports by 1mmt this month to 12mmt, down from 14mmt in the 2023/24 marketing year. Egypt, the European Union and Algeria were all unchanged in this month’s USDA report at 12mmt, 10mmt and 8.5mmt, respectively. Indonesian imports were increased from 11.5mmt in the June report to 12mmt this month, down from 12.6mmt in 2023/24.

The Turkish wheat import forecast was decreased from 9.5mmt to 8mmt following last month’s announcement from the Turkish Agriculture Ministry that it will halt wheat imports from June 21 through mid-October to protect Turkey's farmers from price decreases and other adverse impacts during this year's harvest. The move will impact Russia the most, traditionally Turkey's biggest wheat supplier.

While there is still some way to go, confidence around the northern hemisphere production cycle is increasing, and the major southern hemisphere producers are currently adding tonnes. This means that any depletion in global stocks in the course of the 2024/25 marketing year will likely be minimal, despite the Black Sea crop issues, maintaining downward pressure on prices in the near term.

Call your local Grain Brokers Australia representative on 1300 946 544 to discuss your grain marketing needs.

Share Ag News Via