Sell your Livestock for Free on Farm Tender - All you need to know

- By: "Farm Tender" News

- Farm Tender, DelayPay & Farm Inputs

- May 08, 2023

- 3232 views

- Share

By Dwain Duxson

We have made some changes to our pricing for our Livestock Category. We have flipped the model on its head, done an about-turn, a complete 360. Instead of charging the seller when they sell, we are now charging the buyer when they buy. So for the seller, selling will always be free.

Here is some further information:

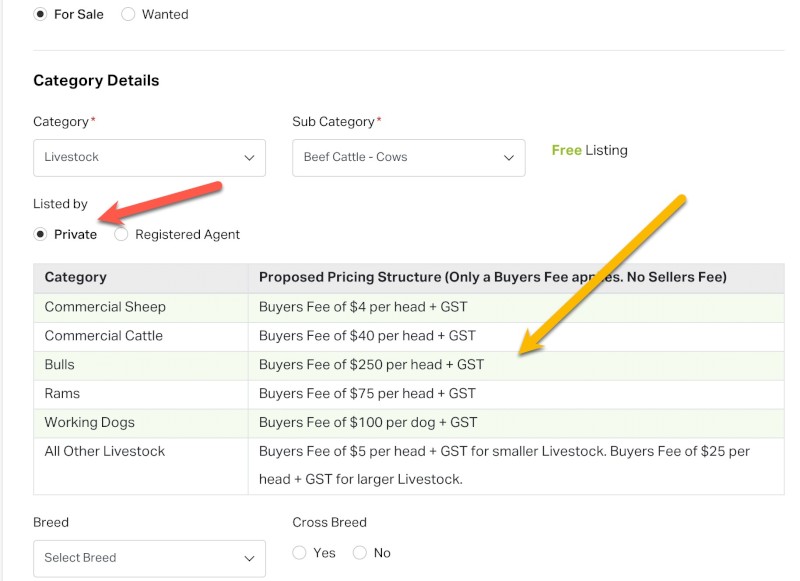

When listing as a "Private" seller (red arrow), the buyer's fees (yellow arrow) will drop down once you select a sub-category. This will give the seller an idea of what the buyer's fees are.

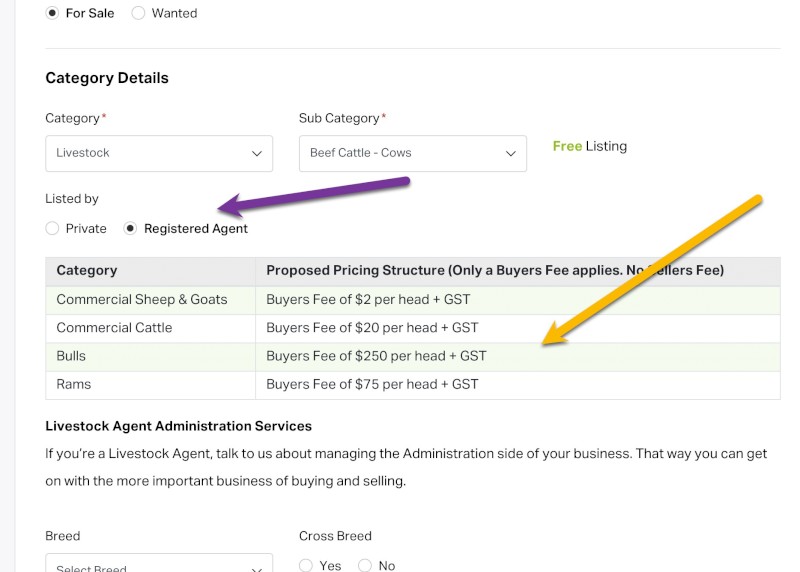

If you are a Livestock agent, you would list as a "Registered Agent" seller (purple arrow). The buyer's fees (yellow arrow) will drop down once you select a sub-category. This will give the seller an idea of what the buyer's fees are. Note that the buyer's fees are cheaper for Commercial Sheep, Goats, and Cattle when listing as a registered "Registered Agent" seller. Why? Because the "Registered Agent" seller will be charging their Farmer client a commission as per normal.

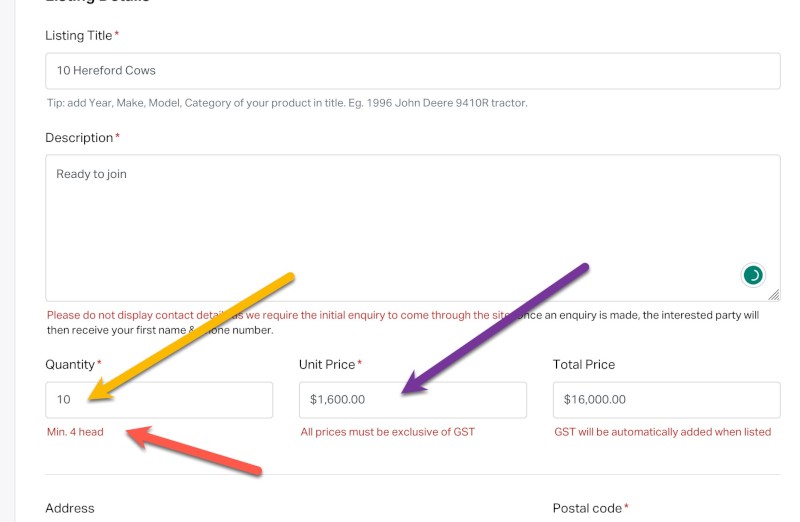

When listing your Livestock, we have a restriction on the minimum number of Livestock you can list. For Commercial Cattle, it's 4 head. For Commercial Sheep, it's 20 head. For Rams and Bulls it's 1 head. The minimum number is outlined in red under the "Quantity" box (red arrow). You would put the exact number of head you have for sale in the "Quantity" box (yellow arrow). In the "Unit Price" box, you would put what you want per head ex GST. Once the listing goes live, it will automatically add the buyer's fee to the price.

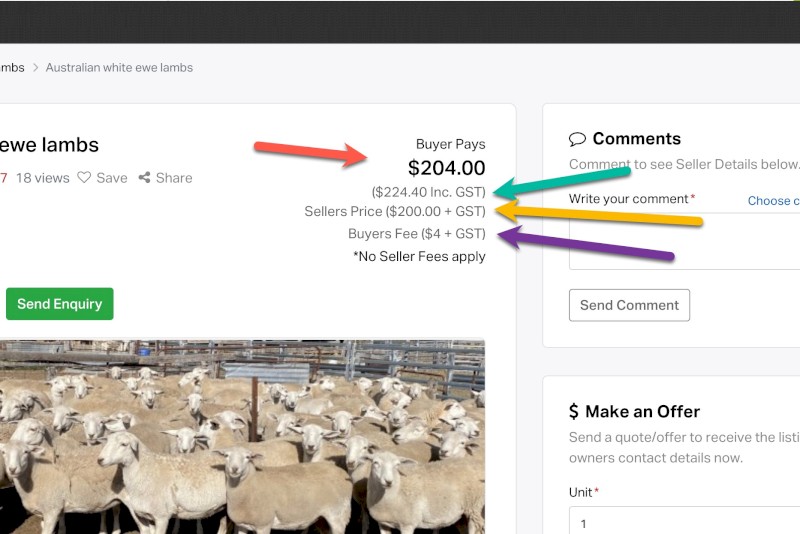

Below we have an example of what a Livestock listing will look like. The "Buyer Pays" price (red arrow) is what the buyer pays. This figure is ex GST but includes the buyer's fee. The figure below is the price inc GST and inc buyer's fee (green arrow). The next one down (yellow arrow) is the price the seller listed it for ex GST. The bottom one (purple arrow) is the buyer's fee for that particular sub-category.

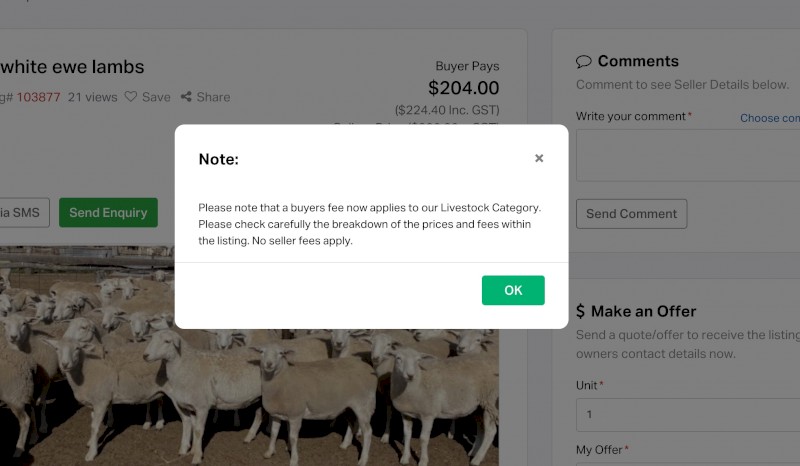

When a potential buyer goes to make a comment or put in an offer, this window opens so they are fully aware that a buyer's fee applies if they do purchase.

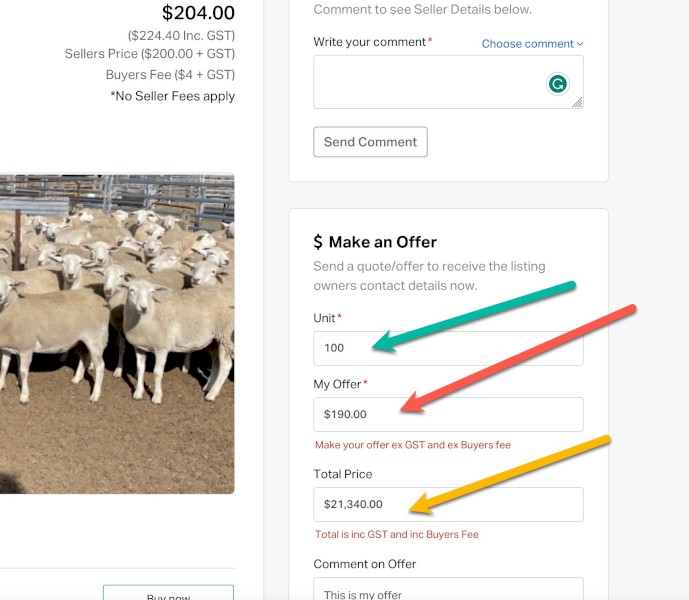

When making an offer, make sure you state the number of head you want to make an offer on under "Unit" (green arrow). Then under "My Offer", put the price you want to offer as ex GST and ex buyer's fee (Red arrow). The system will then calculate the total inc GST and inc buyers fee (yellow arrow).

How does the buyer pay the seller, and how does Farm Tender collect the buyer's fee? There are a few ways this could be done. Option 1). Our preferred method is we do the invoice on behalf of the seller to the buyer and take the funds into our trust account, and then we distribute the funds to the seller less the buyer fee. We call it our NPS system. Option 2). The seller invoices the buyer for the amount, including the buyer's fee, and then we invoice the seller for the buyer's fee.

Note, with Option 1, the seller won't release the Livestock until we have cleared funds in our Farm Tender trust account. We will alert the seller when that happens, and they can release the Livestock.

Farm Tender recommends that you or a trusted party inspect all Livestock before purchasing.

What about the MLA fees? At this stage, the seller would be responsible for paying the MLA fee separately. However, when doing an NPS invoice, we could pay that fee if asked.

How do we deal with Vendor Declarations? You would do this as you normally would.

For any further information or if you have any questions, please contact Dwain Duxson on 0427 011 900 or email dwaind@farmtender.com.au

Share Ag News Via