Rising Victorian Land Values – What on Earth is Going on?

- By: "Farm Tender" News

- Agri Political News

- Dec 02, 2020

- 2347 views

- Share

By ORM

Rising Land Values

Whether you’re at the local pub or having a yarn with your neighbour, chances are that the topic of land values will come up in conversation. The rising value of Victorian farmland continues to catch many farmers by surprise. This leaves them scratching their heads and asking the same questions; why might this be occurring, is this positive for farming businesses, and how does this compare with other investments?

Regional Overview of Victoria

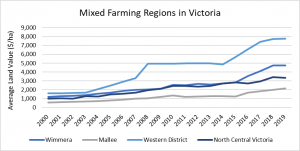

Victoria’s mixed farming regions are great examples of areas that have seen rises in farmland values. The graph below shows that land values ($/ha) have risen quite substantially over the past 20 years for all regions. The extent of these rises over this 20-year period is shown in the dot points below:

- Western District – From $1,580/ha to $7,750/ha

- Wimmera – From $1,204/ha to $4,750/ha

- North Central Victoria – From $1,000/ha to $3,360/ha

- Mallee – From $560/ha to $2,160/ha

Figure 1 Comparison of regional land values for Victoria’s mixed farming regions. Source: Ag Profit® 2020

This graph has come from the Ag Profit dataset and should not be used to value farmland.

The Western District is the standout performer since the year 2000, while the other regions have been consistently growing on a yearly basis. This historical rise in land values begs the question; what are the market drivers that keep pushing these values higher?

These drivers will vary between regions, but ORM believes the most common ones are:

- Reliability in rainfall and production

- Reliability of gross margins

- How tightly the land is held in the local district

- Low debt servicing costs due to low interest rates

- Quality of natural resources like soils, water or pastures

- Property infrastructure and facilities

- Distance and market access

- Commodity outlook

- Industry confidence

Returns from Farmland

Table 1 below shows the annual growth rate of land values in Victoria. The growth for all regions (besides North Central Victoria) has been much higher in the past 5 years when compared against the 10-year and 20-year average. For example, farmland in the Wimmera region has achieved an average annual growth rate of 10.4% since 2015. This is positive for farmers because the land’s (an asset) growth in value directly increases the owner’s equity. In addition, the profit earned from farming or leasing will also contribute to the overall return. Therefore, the combination of growth and profit will determine the land’s overall Return on Investment (ROI).

Table 1 The average annual % growth per region, exclusive of profit. Source: Ag Profit® 2020

This table is based on the Ag Profit dataset and the % growth will vary between local districts within these regions.

Investment Comparison

Farmland has not been a traditional asset in an investor’s portfolio. However, ORM has noticed that the sound returns have attracted more attention from investors recently. This is because the combination of an increasing asset value plus the ability to generate profit hits the ‘sweet spot’ for some investors, depending on their investment strategy. The table below shows that the average return of 8.0% from rising land values is competitive with the traditional growth assets (real estate and shares) and defensive assets (bonds and cash).

Table 2 Comparison of returns for different types of investments. Source: Vanguard 2020 and Ag Profit® 2020

Rising land values continue to attract the attention of the Victorian Agricultural Industry. Based on the trends shown in the graph, you could assume that values will continue to rise over the long term. Farmland has provided a strong return in recent years, resulting in many farmers and land holders successfully growing their equity. Are you interested in knowing how rising land values have impacted your equity and what this means for your business? If so, then get in touch with ORM / Ag Profit® and enquire about our FREE benchmarking service.

Get in touch to find out more Contact Us

Share Ag News Via