La Niña announces its arrival in grand style…

- By: "Farm Tender" News

- Cropping & Grain News

- Nov 30, 2021

- 552 views

- Share

By Peter McMeekin

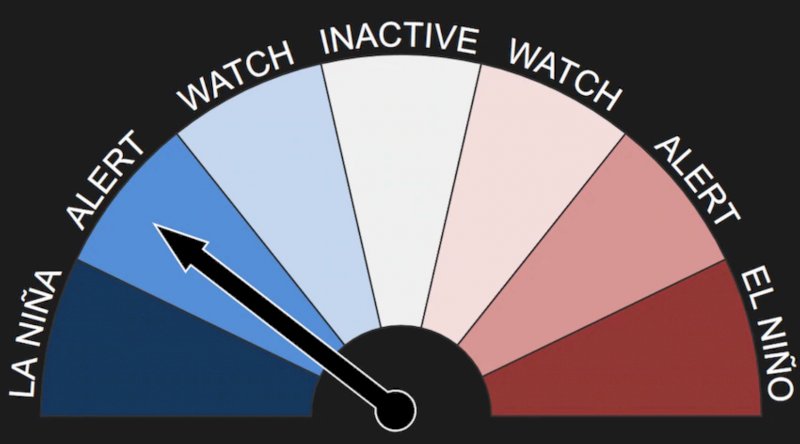

The Australian Bureau of Meteorology (BOM) has finally confirmed what the constant stream of rain-bearing storm clouds have been telling the eastern Australian farmer for most of the month: La Niña has arrived!

The BOM has had a La Niña ‘alert’ in place for a couple of months now and has been forecasting the ocean cooling trend in the tropical Pacific Ocean to continue toward La Niña levels. On November 25, the BOM released its latest three-month climate outlook, officially declaring the weather phenomenon.

This has coincided with the slow disintegration of the negative Indian Ocean Dipole (IOD). A negative IOD is typically associated with above-average rainfall over parts of southern Australia. It is expected to move into neutral territory in the next few weeks, in line with its typical seasonal cycle.

A positive Southern Annular Mode (SAM) is the third climatic influence in play at the moment. The SAM refers to the (non-seasonal) north-south movement of the strong westerly winds that blow almost continuously in the mid-to-high latitudes of the southern hemisphere. This belt of westerly winds is generally associated with storms and cold fronts that move from the west to the east of the continent, bringing rainfall to southern Australia.

According to the bureau, this month has been amongst the top ten wettest Novembers on record. The nation’s capital, Canberra, has recorded its wettest November since records began in 1939. In the central west of New South Wales, the towns Orange, Cowra and Condobolin have all recorded their wettest November in more than 100 years.

Extremely heavy rainfall swept across the eastern states of Australia on Thursday and Friday of last week, exacerbating the widespread flooding already occurring in a number of creek and river systems. Multiple flood warnings have been issued, primarily across Queensland and New South Wales.

What’s more, the climate models are indicating the La Niña thresholds are planning to hang around until late summer, leading to a wetter than average outlook for the next three months. While this will be great news for summer crop prospects in northern News South Wales and Queensland, it is a nightmare for farmers who are battling to get their winter crop harvested. Substantial quality downgrades are now inevitable.

Seasonal conditions have been favourable for winter crop production across almost the entire country this year. Western Australia has been the standout, with production up significantly on 2020. The state has been an oasis for most of the year, getting regular top-up rain events in most regions across the entire growing season.

The picture in South Australia and Victoria is not as rosy as last year, with a poor soil moisture profile leading to a late start in many districts. The Mallee regions in both states have had well below average growing season rainfall, and production of all crops have suffered accordingly.

New South Wales has had a repeat of 2021, with above-average rainfall in almost every cropping region, except for the southwest corner bordering the Victorian Mallee. However, the planting period was too wet in parts of the north which delayed planting and led to poor crop establishment in some districts. That said, production prospects for the state were on par with a year earlier before the unwelcomed November rain events.

The 2020 harvest saw Australia produce a record wheat crop of 37 million metric tonne. Prospects are still high for another record this year, but the gloss has undoubtedly been taken off the New South Wales crop in recent weeks. Nevertheless, I am still calling the national wheat crop 38 million metric tonne on the back of a bigger planted area, but the bias has definitely turned negative following the eastern state deluge.

The big difference this year is the huge wheat crop in Western Australia, which is more than making up for lower production in both Victoria and South Australia. Wheat production in New South Wales is now unlikely to match last year’s record tally, but it will still be the second biggest on record and well ahead of third.

The Queensland harvest is winding down in most districts, but much of the inner Darling Downs crop is still in the paddock. Wheat production is expected to surprise to the upside with good yields reported over a much larger planted area than 2020, and output is forecast to be more than double that of last year.

National barley production is expected to be lower year on year. Continued uncertainty around Chinese demand, buoyant global oilseed values and an excellent start to the season in New South Wales and Western Australia saw a widescale switch to canola when planting commenced in autumn. At 13.5MMT, the crop will be around 0.5MMT lower than last year’s record output.

The Australian canola crop is officially a bin buster. Last year’s record crop of 4.28MMT has been totally eclipsed, dwarfed by a crop that has flourished in the lap of luxury since planting. It has wanted for nothing, with a long, mild and moist growing season. Consequently, production is expected to be at least 6MMT, 40 per cent higher than the 2020 crop. While that may seem high to some, there are plenty of trade estimates north of that number.

However, the international gaze is firmly on the quality of the Australia wheat crop at the moment. The world has been banking on Australia to alleviate the global dearth of protein wheat following poor harvests in the northern hemisphere’s major export nations.

The issue is two-fold. Firstly, the rain in New South Wales will potentially see 6MMT of high protein wheat downgraded to feed wheat as test weights tumble and sprouting renders it unusable for the milling process. The domestic stockfeed industry may be jumping for joy as feed wheat values plummet, but the millers are scrambling for cover.

The second area of concern is Western Australia, where the protein profile is a major headache. It seems that this year’s crop has directed its energy toward quantity rather than quality. With around 25 per cent of the crop harvested, 47.5 per cent of receivals to date are being directed into the ASW1 stack. Last year only 28 per cent of receivals were classified as ASW1. The stack average is running at around 8.5 per cent protein compared to almost 9 per cent last year. This year only 28.7 per cent of the receivals are being classified as milling wheat. Last year 47.8 per cent of total harvest receivals went into the H1, H2, APW1 or APW2 bins.

Collectively, these issues will diminish blending opportunities and will drastically reduce the amount of Australian milling quality wheat available for export over the next twelve months, despite the bigger crop.

Call your local Grain Brokers Australia representative on 1300 946 544 to discuss your grain marketing needs.

Share Ag News Via