Farmers quick to secure Wheat futures as market spikes

- By: "Farm Tender" News

- Cattle News

- May 09, 2018

- 770 views

- Share

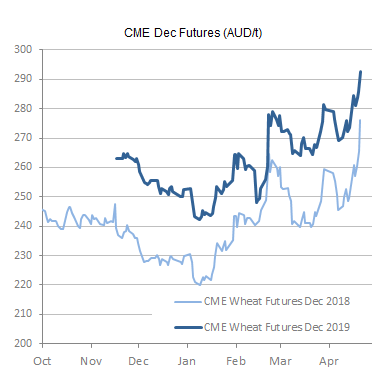

May to July is a particularly active time for locking in forward contracts as wheat futures tend to be more volatile during these times because of uncertainty over spring US weather patterns and production estimates. If growers are quick, they are able to turn this volatility to their advantage and lock in contracts when prices spike.

Forwarding marketing can be complex. We try to make it as easy as possible through our price risk management tools. A popular tool with growers is our AWB Basis PLUS contract – which is a unique product that allows growers to fix basis and futures prices separately and in any order.

We manage the transaction on the futures exchange and look after the foreign exchange risk on the growers’ behalf. There is no need to access funding to support the futures position or have a line of credit with a financial institution. The cost to the grower is a flat dollar per tonne fee.

Growers are increasingly thinking holistically about their marketing and developing a long term plan. We work with our customers to understand their marketing objectives - including their production plan and price targets. If we know their target marketing price, we can alert the grower when wheat futures reach those levels and give them the option to lock in part of their future crop at those prices. This saves them having to watch the futures market daily.

I have been working with growers to help them managing their price risk for about ten years and there is no doubt, these types of marketing tools are becoming more popular with the number of growers registering with us increasing every year. There are few other tools that provide growers with options to manage their price this far out which is why the Basis PLUS is attractive to so many and is worth considering as part of any marketing plan.

Share Ag News Via