Bought or about to by a new Property - Read this.

- By: "Farm Tender" News

- Farm Tender, DelayPay & Farm Inputs

- Jun 07, 2024

- 750 views

- Share

Did you know if you bought a Property, you claim depreciation on any of the assets? Many people would buy a property and not even consider this. There is an organisation that can do it all for you, BMT; see at the bottom of the page.

Below is a letter sent to one of our Members.

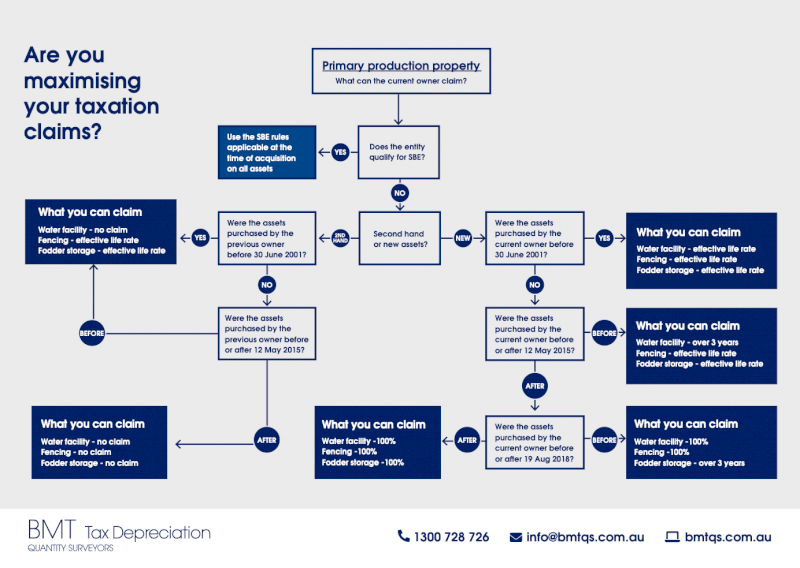

As the Australian Taxation Office (ATO) has several special rules for depreciating assets (particularly water facilities, fencing assets, fodder storage and horticultural plants), we look at each asset individually to ensure its specific rules are applied correctly, and the maximum possible deductions are being claimed for the property.

I have listed some questions below that will assist me to provide a quotation and estimate of the likely initial deductions. Please note: some details may not be required.

- Address:

- Please advise if there are multiple titles, and if there is any need for them on separate reports (e.g., if they have different settlement dates, if they might be sold separately in future, etc.):

- Approximate settlement date:

- Approximate purchase price:

- Please advise the property use (cattle, sheep, crops, etc.):

- Does the entity that owns the property qualify as a Small Business Entity (SBE, with aggregated annual turnover of less than $10 million)? It is best not to confirm this if you are not certain of the answer. Please check with your accountant, or, if you provide their details, we will contact them on your behalf to ask them.

- Does the entity that owns the property quality as a primary producer?

- Size of the land:

- If there is a homestead(s) on the property, please advise its use (principal place of residence, manager’s residence/worker accommodation). Rough size and age are also helpful details but not required. Please note if it came furnished:

- Any shedding onsite (size and type is quite helpful here):

Please provide a description/number of the following structures/infrastructure onsite, where applicable. Approximate numbers are fine, and some items may not be relevant, so please provide what you can:

- Dams:

- Bores and windmills:

- Pumps:

- Troughs:

- Tanks:

- Paddocks:

- Fencing — is the perimeter fully fenced? Please advise the approximate length of fencing if known:

- Silos and fodder storage:

- Dairy, including equipment if not noted in the shed section above:

- Sheep/cattle yards, including ramps and crushes:

- Generators:

- Any other notable fixed infrastructure not mentioned above

- Description of any renovations/improvements that have taken place since settlement:

- Do you require loose assets/equipment such as tractors, quads, hand tools, etc., to be included in this report?

- If so, please provide a description/inventory list of these assets:

- Are these assets owned by the same entity as the landholder or a separate trading entity?

Once I receive the above information, I’ll be able to supply you with a fee proposal and an estimate of the opening full financial year's deductions or immediate write-off where possible and appropriate. I will follow this up with you shortly, but please contact me with any questions or updates in the meantime and I'm more than happy to have a discussion with you.

Share Ag News Via